Deed Street Capital is a

What Is My Note Worth?

- Value of the property

- Loan to value or equity in the property

- The credit scores of the payor(s)

- Payment history

- Property type

Deed Street Capital purchases private mortgage notes secured by commercial and residential properties with note balances from $25,000 up to $3,000,000.

Who Is Deed Street Capital and How to Sell My Mortgage Note?

Deed Street Capital is located in Conshohocken, PA, a suburb of Philadelphia.

Why Clients Choose Deed Street Capital?

At Deed Street Capital, we pride ourselves on delivering unparalleled service and exceptional value to our clients. As a direct buyer, we eliminate middlemen, ensuring you receive the most competitive offer for your private mortgage note. Here’s why so many note sellers trust us with their financial goals:

- No Hidden Fees: Transparent pricing ensures you receive the best offer without surprise deductions.

- Nationwide Service: We work with sellers across all 50 states, offering unmatched flexibility and expertise.

- Fast, Hassle-Free Closings: With a streamlined process, most transactions are completed within 30 days.

- Competitive Pricing: We’re committed to providing offers that maximize the value of your note.

- Trusted Expertise: Backed by 20+ years in the industry, we evaluate each note with precision and care.

“Deed Street Capital made the process simple and stress-free. I was able to sell my private mortgage note quickly and at a great price!” – John R.

We invite you to explore Deed Street Capital reviews to see why so many note sellers choose us as their trusted partner.

Why Sell My Mortgage Note to Deed Street Capital?

- Capitalize on an investment opportunity

- Pay off existing debts or loans

- Accomplish a time-sensitive goal

- Diversify your assets

- Solve an immediate cash flow problem

- Qualify for Medicare or an assisted living program

How Seller-Financed Mortgage Note Sales Work with Deed Street Capital

Flexible Options for Selling Your Mortgage Note

At Deed Street Capital, we understand that every seller’s situation is unique. That’s why we offer flexible solutions tailored to your needs, including the option to sell your mortgage note in full or in part. Whether you need immediate cash flow or want to retain some payments for future income, our team ensures a seamless and hassle-free process.

Why Choose Deed Street Capital?

- Sell your mortgage note fast and efficiently.

- Choose between full or partial note sales for maximum flexibility.

- Nationwide service with no hidden fees.

Start exploring your options today and discover how Deed Street Capital can help you achieve your financial goals.

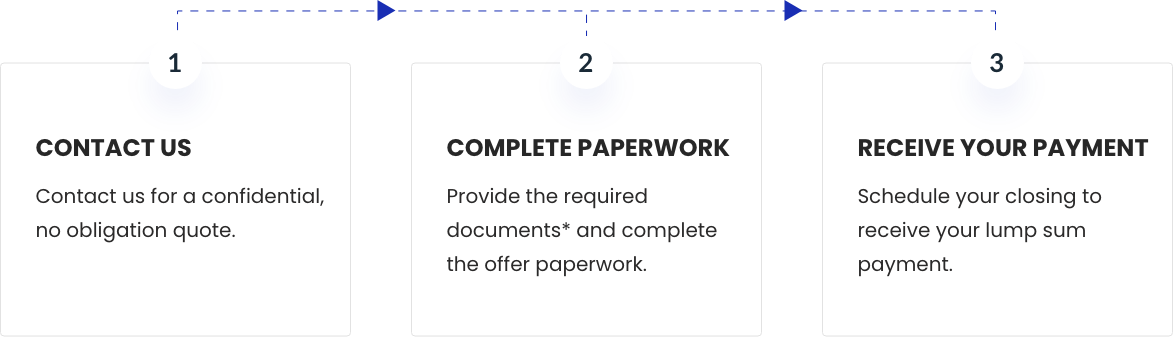

See Deed Street Capital's Process in Action

Contact Deed Street Capital to discuss your mortgage note.

Select a purchase option and provide documents for underwriting review.

Purchase documents prepared for execution, signed and returned.

Due diligence period to collect and verify information.

Closing is scheduled at a local title company or law firm

Funds are sent to you by check or electronic fund

Deed Street Capital is located in Conshohocken, PA, a suburb of Philadelphia.

With extensive experience, Deed Street Capital has helped thousands of people unlock the value of their monthly payments by purchasing valuable assets such as notes, loans, and deeds.

Deed Street Capital can help you get the funds you need quickly, allowing you to move forward with your plans confidently.

FAQs

While the sale price of a mortgage note can range from 65% to 95% of its face value, the actual amount depends on factors such as the note’s payment history, the borrower’s creditworthiness, the interest rate, and the remaining term. Deed Street Capital specializes in offering competitive pricing tailored to the unique attributes of each note, ensuring sellers get maximum value.

Selling a mortgage note involves several steps: First, contact a reputable note buyer like Deed Street Capital for a no-obligation quote. Next, provide the necessary documentation for underwriting and due diligence, including the note, payment history, and property details. Once the terms are agreed upon, a closing date is set, and the funds are transferred to you. Deed Street Capital streamlines the process with in-house underwriting, offering fast closings, clear communication, and competitive pricing.